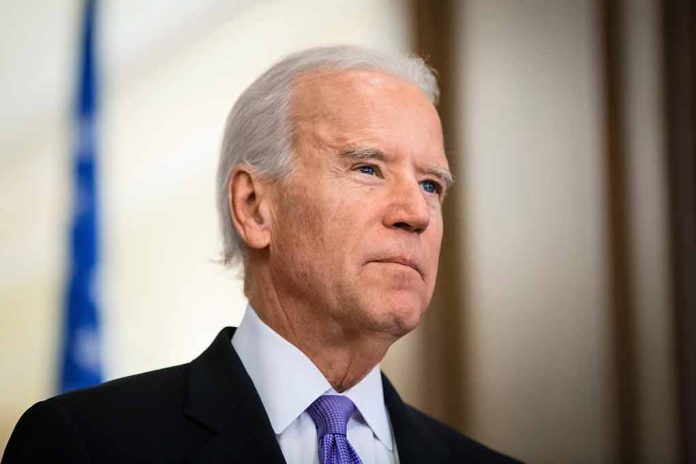

(BrightPress.org) – The Biden administration’s latest grasp at student debt relief may have stronger legal standing than the first attempt at widespread debt cancellation that the Supreme Court struck down in 2023.

There are key differences between President Joe Biden’s new plan and his 2022 attempt at canceling student debt. The 2022 plan relied on emergency powers bestowed upon the Education secretary during the pandemic whereas the current plan is based on the Higher Education Act (HEA). Under the HEA, the U.S. Department of Education has the authority to fix problems in the student loan system. The Biden administration has logged more hours researching the legality of the current proposal. According to Sara Partridge, the senior policy analyst for the Center for American Progress, the “pathways are legally sound” and the Biden administration is “following the letter of the law.”

Instead of widespread debt cancellation, the current plan targets certain categories of borrowers. The category with the broadest relief targets borrowers who owe more than they originally borrowed due to run-away interest. Long-time borrowers who have been paying for at least 20 to 25 years would be eligible to have their debt canceled. Borrowers who were cheated by colleges or completed programs with “low financial value” would have debt automatically canceled in most cases. Borrowers who already qualify for debt relief programs but have had difficulty with paperwork would be eligible for relief, as well as several borrowers facing “financial hardship.”

As of Tuesday, April 16th, the current plan is moving forward as a proposed regulation for four of the categories of borrowers. There will be a required 30-day period for public comment and another review before the regulation can be finalized. A separate proposal for borrowers experiencing financial hardship will be filed in the “coming months.”

Republicans remain opposed to any broad student-debt relief that places the tax burden on those who have either never attended college or have already paid off their debt.

Copyright 2024, BrightPress.org